Renewed fears of a “hard landing” recession have emerged from the grave and are walking among us1. While many analysts hoped the U.S. economy could achieve a “soft landing,” that optimism might be misplaced.

Why Are Economists Worried About a Recession?

The Labor Market

One major concern is the labor market. The latest report showed just 175,000 jobs were added in April, a significant drop from March’s 315,000 and below analysts’ expectations2. Moreover, job numbers from previous months were revised downward, indicating softness in what has been a cornerstone of economic strength.

However, there are two important points to consider:

- A slowing jobs market might help the Federal Reserve feel more confident that inflation will eventually hit their 2% target, potentially opening the door to cutting interest rates.

- Trends are more important than a single weak report, so it’s essential to keep watching the data.

Other Warning Signals

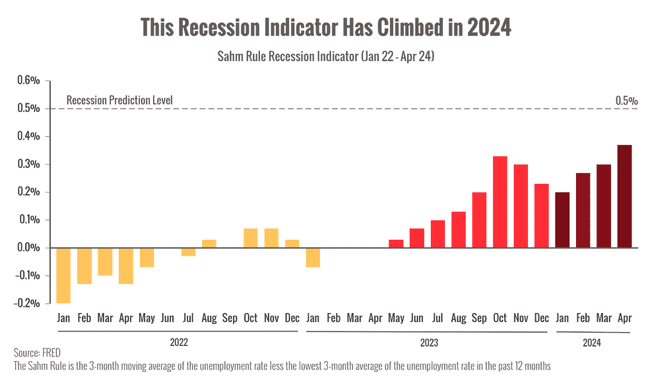

Another warning signal is the “Sahm Rule” indicator, which tracks changes in the unemployment rate to predict recessions. Historically, when the unemployment rate’s 3-month moving average rises 0.5% above its 12-month low, it signals the early stages of a recession.

While the Sahm Rule isn’t indicating a recession yet, it’s getting close3.

Signs of Economic Strength

Despite these concerns, there are signs of strength in the economy. Although economic growth slowed significantly in the first quarter of 2024, American consumers are still spending, especially on services. In Q1, spending on services grew at a 4.0% annual rate, the fastest surge since 20214. This is a critical indicator since consumer spending accounts for 70% of economic growth.

Moreover, income (after adjusting for inflation) is at its strongest since 2007, as wage growth outpaces inflation5.

The Complex Economic Picture

In summary, the economic picture is complicated. We’re still dealing with the effects of several years of high rates, pandemic recovery, and other factors that blur the economic outlook. This year’s market performance has hinged on one big question: When will the Fed cut interest rates?

The economy’s strength and persistent inflation have delayed expectations for rate cuts. However, signs of a slowing economy might give the Fed the confidence to ease rates. Lowering rates would reduce the cost of mortgages, auto loans, credit cards, and other debt, which has made it difficult for many Americans, especially low-income consumers, to feel financially secure.

Soft landings are tough to achieve, and while one is still possible, at Semmax, it’s our job to prepare for multiple potential outcomes.

Sources:

- https://finance.yahoo.com/news/u-economy-headed-hard-landing-222148023.html

- https://www.cnbc.com/2024/05/03/jobs-report-april-2024-us-job-growth-totaled-175000-in-april.html

- https://www.businessinsider.com/recession-outlook-hard-landing-economy-unemployment-job-market-david-rosenberg-2024-4

- https://finance.yahoo.com/news/u-economy-actually-wolf-sheep-192424119.html

- https://hbr.org/2024/05/the-u-s-economys-soft-landing-is-still-on-track

Chart Sources: https://fred.stlouisfed.org/series/SAHMREALTIME#0