As we usher in 2024, it’s essential to pause and reflect on the previous year’s market and economic trends to prepare for what the new year might bring.

AI Takes Center Stage

In 2023, AI technology, particularly following the launch of ChatGPT, emerged as a dominant trend. This tech revolution has significantly altered the landscape and is anticipated to continue its influential role as it matures and finds more applications in various business operations.1

Navigating Through Banking Turbulence

The year saw a jolt in the banking sector, with major institutions like Credit Suisse stumbling due to exposure to risky assets. The swift action by regulators helped avert a broader crisis, showcasing the financial system’s resilience despite initial fears.2

Washington’s Financial Drama

Repeated threats of government shutdowns and political brinkmanship in Washington have had tangible impacts. The U.S. credit and financial outlook faced downgrades, which might ripple into increased consumer borrowing costs.3,4

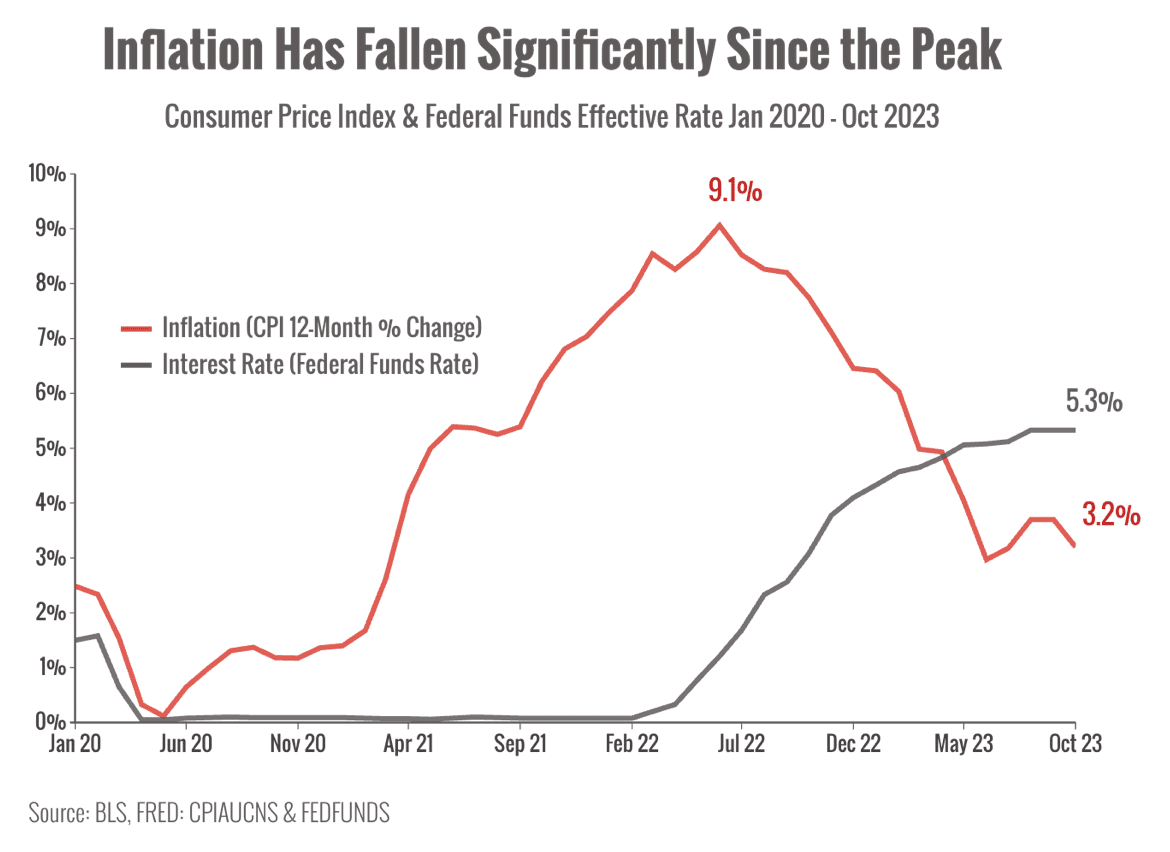

Interest Rate Dynamics

2023 continued to grapple with the tug-of-war between high inflation and interest rates. With inflation now on a downward trend, there’s speculation that the Federal Reserve might shift gears from hiking to cutting rates in the near future.5

Economic Resilience

Contrary to recession fears, the economy displayed robust growth thanks to strong consumer spending. This trend challenges the narrative of an imminent recession and raises questions about the economic trajectory in 2024.6

Stock Market’s Roller Coaster Ride

The stock market experienced significant volatility but ultimately rallied, signaling a potential shift to a bull market. However, opinions vary, and it remains to be seen whether this upward trend will continue into 2024.7,8

Looking Ahead to 2024

The coming year promises to be eventful, with the impending election likely to induce market volatility. While some predict a looming recession, others remain optimistic. The consensus? Vigilance and adaptability will be key.

Final Thoughts

As we step into 2024, it’s crucial to stay informed and prepared for various scenarios. Here’s to a year of prosperity, joy, and achieving your financial goals!

Sources:

- https://www.mckinsey.com/capabilities/quantumblack/our-insights/the-state-of-ai-in-2023-generative-ais-breakout-year

- https://www.gao.gov/blog/march-2023-bank-failures-risky-business-strategies-raise-questions-about-federal-oversight

- https://www.reuters.com/markets/us/moodys-changes-outlook-united-states-ratings-negative-2023-11-10/

- https://www.fitchratings.com/research/sovereigns/fitch-downgrades-united-states-long-term-ratings-to-aa-from-aaa-outlook-stable-01-08-2023

- https://www.kiplinger.com/economic-forecasts/interest-rates

- https://www.usbank.com/investing/financial-perspectives/market-news/economic-recovery-status.html

- https://www.jpmorgan.com/insights/outlook/market-outlook/a-2023-look-back-what-we-got-right-and-wrong

- https://www.reuters.com/markets/us/bull-market-view-after-sp-500-hits-fresh-year-high-2023-12-04/

Chart sources: https://fred.stlouisfed.org/series/FEDFUNDS, https://fred.stlouisfed.org/series/CPIAUCNS